Sales Tax For Charlotte Nc – For those considering buying a business, the appeal often lies in the opportunity to take over an existing operation and build upon its foundation. The materials, labor, and expertise that go into crafting these items naturally make them more expensive. The market for second-hand goods is also influenced by societal trends and economic conditions. They become part of the story of the buyer and the creator, connecting people to a tradition of excellence, heritage, and care. Technological advancements and shifts in consumer behavior can also impact the types of businesses that buyers are interested in. For those on a budget or looking to stretch their money further, second-hand markets provide an opportunity to purchase goods that would otherwise be out of reach. These goods aren’t just products; they are symbols of craftsmanship, heritage, and pride. It’s about change, opportunity, and the negotiation of value. It is subjective, shaped by cultural norms, individual preferences, and the evolving standards of various industries. Yet, at the same time, there’s the promise of new beginnings for both the seller and the buyer. This has made it easier for people to find items that might have otherwise been out of reach, whether it’s a rare collectible, an antique, or a product from another country. For fashion-conscious individuals, buying second-hand is a way to express their personal style while also supporting sustainable practices. Whether through local thrift stores, online marketplaces, or garage sales, the option to buy pre-owned items has created a flourishing market that continues to grow. A well-made frying pan or a durable pair of boots might not have the cachet of a designer handbag, but their value lies in their functionality and reliability. The process of selling it can be seen as a form of letting go, a recognition that the future may look different from the past, but that doesn’t diminish its importance or value. Selling such an item can be a difficult decision, yet it often represents the practical need to downsize or make space for something new. Second-hand goods, especially those that are vintage or antique, often carry a sense of history and craftsmanship that can be missing from mass-produced products. There are communities that exist outside the realm of traditional commerce, where sharing, collaboration, and mutual support take precedence over profit. The perceived high cost of these items has led some to opt for cheaper alternatives. This is especially true in a world dominated by fast fashion, disposable electronics, and mass-produced products.

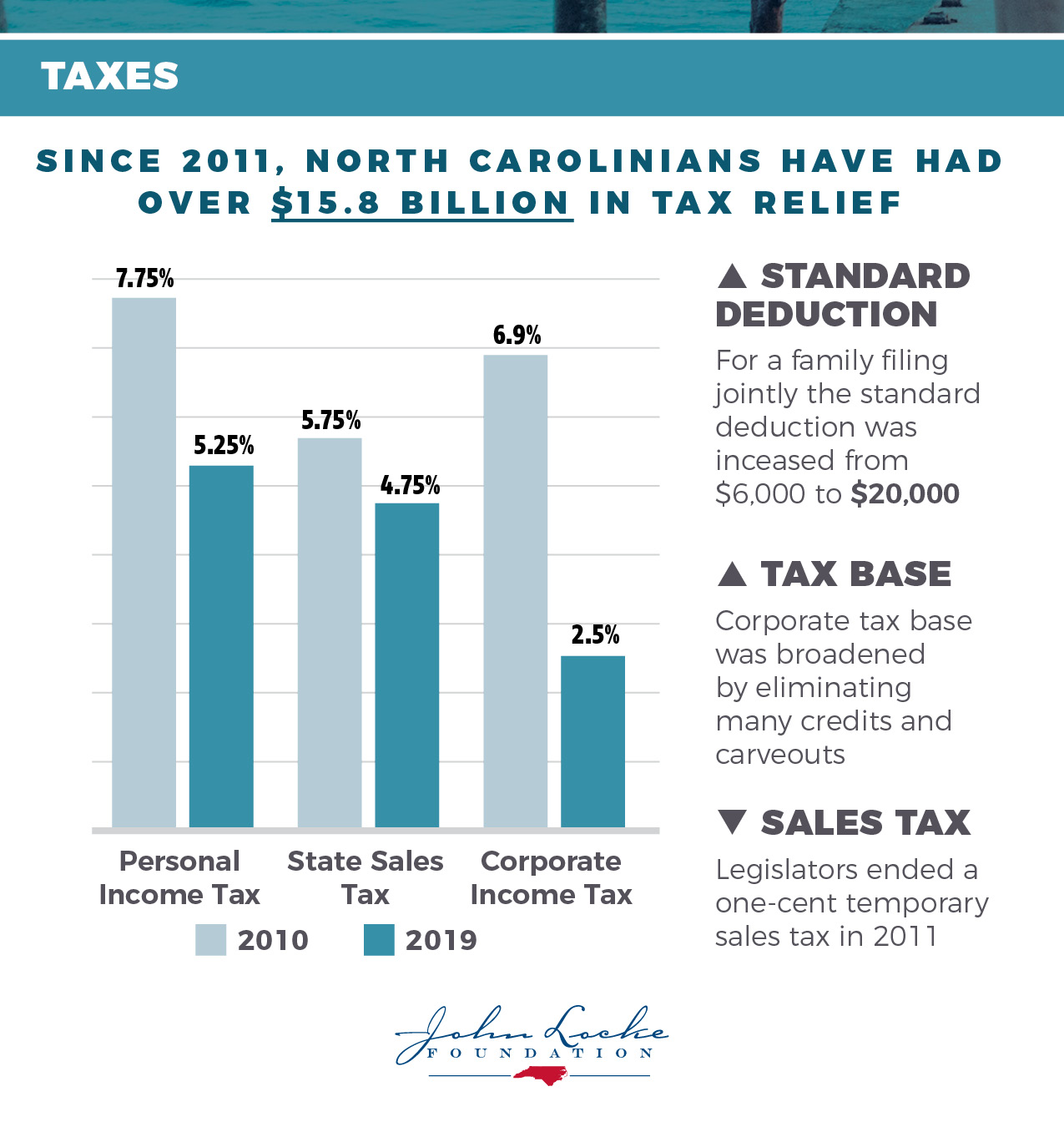

North Carolina Sales And Use Tax Rates 2023

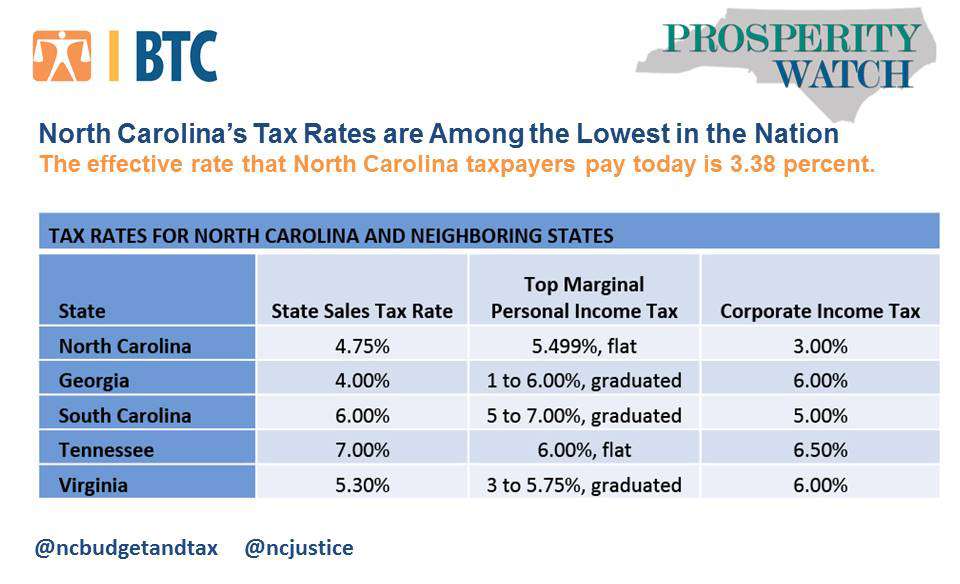

The latest sales tax rate for mecklenburg county, nc. By wsoctv.com news staff january. Sales tax rates in mecklenburg county are determined by six different. The 28273, charlotte, north carolina, general sales tax rate is 7.25%. The latest sales tax rates for cities in north carolina (nc) state.

North Carolina Sales Tax Rates 2024

The minimum combined 2025 sales tax rate for charlotte, north carolina is 7.25%. Charlotte sales tax rate is 7.25%. The latest sales tax rates for cities in north carolina (nc) state. There is no applicable city tax. Charlotte, nc sales tax rate.

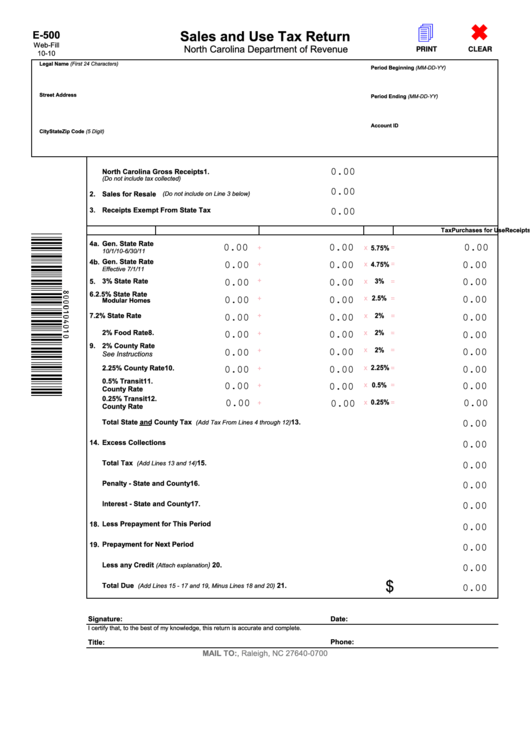

Fillable Sales And Use Tax Return North Carolina Department Of

There is no applicable city tax. 2020 rates included for use while preparing your income tax deduction. The latest sales tax rates for cities in north carolina (nc) state. Discover our free online 2024 us sales tax calculator specifically for charlotte, north carolina residents. Learn about the 2024 sales tax rates in charlotte, nc, and how to stay compliant with.

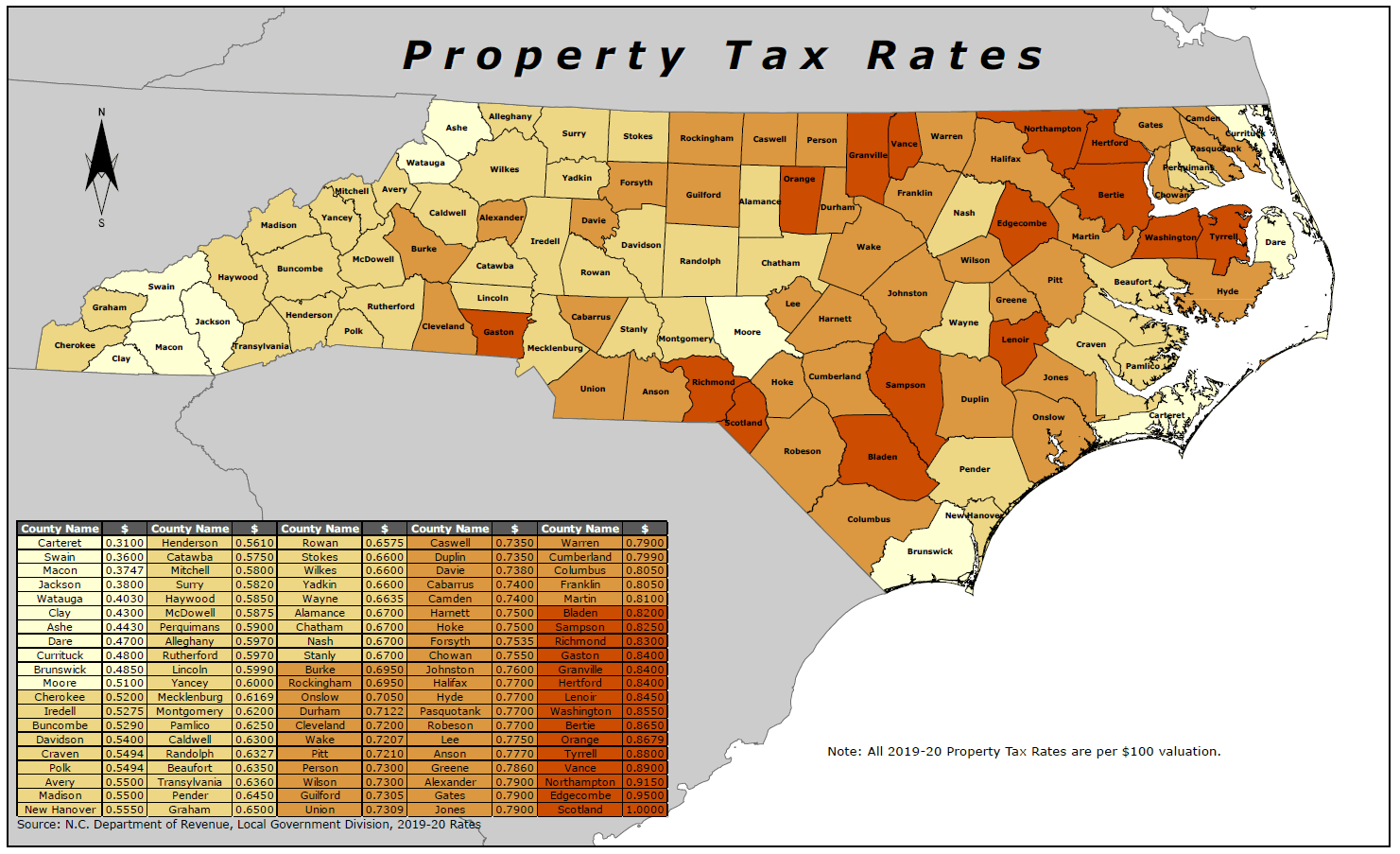

Nc Sales Tax Rates 2022 By County

The minimum combined 2025 sales tax rate for charlotte, north carolina is 7.25%. Mecklenburg county, north carolina has a maximum sales tax rate of 7.25% and an approximate population of 726,893. If you have a sales tax collection obligation, you need to register with the north carolina department of revenue as a. How 2024 sales taxes are calculated for zip.

Charlotte County will hold vote to extend sales tax

Charlotte, nc sales tax rate. The current total local sales tax rate in charlotte, nc is 7.250%. Sales tax rates in mecklenburg county are determined by six different. This includes a 4.75% state tax, a 2% mecklenburg county tax, and a 0.5% special tax applicable for certain. Discover our free online 2024 us sales tax calculator specifically for charlotte, north.

Plan would redistribute NC sales tax revenue Charlotte Observer

The latest sales tax rates for cities in north carolina (nc) state. The current sales tax rate in charlotte, nc is 7.25%. The latest sales tax rate for mecklenburg county, nc. This is the total of state, county, and city sales tax rates. The minimum combined 2025 sales tax rate for charlotte, north carolina is 7.25%.

Nc State Sales Tax 2024 Jada Rhonda

Mecklenburg county, north carolina has a maximum sales tax rate of 7.25% and an approximate population of 726,893. 828 rows north carolina has state sales tax of 4.75%, and allows local governments to collect. Rates include state, county and city taxes. The latest sales tax rates for cities in north carolina (nc) state. The combined sales tax rate for charlotte,.

.png)

Nc State Sales Tax Rate 2024 Renie Charmain

Your total sales tax rate combines the north carolina state tax (4.75%) and the mecklenburg county sales tax (2.50%). The minimum combined 2025 sales tax rate for charlotte, north carolina is 7.25%. Use our calculator to determine your exact sales tax rate. Rates include state, county and city taxes. Here's what you need to know about collecting sales tax:

North Carolina Sales Tax Rates 2023

The total sales tax rate in charlotte comprises the north carolina state tax, the sales tax for mecklenburg county, and any applicable special or district. The combined rate used in this calculator (7.25%) is the result. The current sales tax rate in charlotte, nc is 7.25%. Charlotte, nc sales tax rate. Charlotte public transportation city leaders are hoping the state.

GP CPA Charlotte Sales Tax News Update » North Carolina CPA

This includes a 4.75% state tax, a 2% mecklenburg county tax, and a 0.5% special tax applicable for certain. Charlotte public transportation city leaders are hoping the state legislature will allow voters to weigh in on a sales tax increase for transit. Here's what you need to know about collecting sales tax: Charlotte, nc sales tax rate. The current total.

This is especially true in a world dominated by fast fashion, disposable electronics, and mass-produced products. For example, someone might be able to purchase a used smartphone or laptop with the same features and specifications as a brand-new model, but at a significantly reduced price. These platforms provide a convenient way for sellers to connect with potential buyers, set their prices, and arrange for shipping or pick-up. The business-for-sale market continues to evolve, influenced by economic trends, technological advancements, and shifts in consumer behavior, but one thing remains clear: buying and selling businesses will always be a fundamental part of the global economy. Online platforms also offer the convenience of searching for specific items, whether it’s a rare collector’s item, a particular brand of clothing, or a piece of furniture that fits a specific design style. The world may increasingly operate under the assumption that everything is for sale, but the human spirit, with its capacity for love, creativity, and compassion, refuses to be bought. People are rediscovering the value of items that have been made by hand, with care and skill, as opposed to the impersonal, assembly-line products that dominate the marketplace. In the end, the real challenge is to navigate this world — to understand the forces of commerce that shape our lives, while holding onto those things that remain beyond the reach of money. Perhaps the most troubling aspect of the idea that everything is for sale is how it can shape the way we view the world and each other. Social movements and grassroots organizations work tirelessly to provide resources and support to those who need it, often without expecting anything in return. It’s about letting go of something that no longer serves a purpose, while opening the door for something new to take its place. The perceived high cost of these items has led some to opt for cheaper alternatives. Some businesses are sold because the owner is ready to retire, while others might be sold due to financial difficulties or changes in the owner’s personal or professional life. This practice is an essential aspect of sustainability, as it helps conserve resources and reduces the amount of waste sent to landfills. They are investments, not just purchases, and their value is often felt long after the original transaction has ended. This can be particularly advantageous for entrepreneurs who might have experience in business operations but lack the time or resources to build a new venture from the ground up. The idea of “everything for sale” challenges our understanding of what is sacred, what is essential, and what is truly priceless. The second-hand market is not just about saving money; it’s about embracing a more sustainable, mindful way of consuming that values reuse, repurposing, and the stories behind the items we choose to keep. A new smartphone, for example, can cost hundreds of dollars, but buying a used one can cut the price down by more than half. In a sense, the very nature of human existence can feel like a transaction.

It is only through diligent research that a buyer can truly determine whether the business is worth the asking price. One common concern is the risk of purchasing items that are damaged or not as described. Whether you’re the seller or the buyer, the phrase “for sale” is a reminder that everything in life is in constant motion, always moving toward something new, something different, something better. The durability and longevity of these products mean they don’t need to be replaced as frequently, reducing the need for constant purchases and ultimately saving money in the process. The production of new goods often requires significant resources, such as raw materials, energy, and labor, while also generating waste and contributing to pollution. While some people may be hesitant to purchase pre-owned electronics due to concerns about quality or reliability, the second-hand market for electronics has become increasingly trustworthy. Whether it’s a car, a house, or a simple piece of furniture, there’s a process that unfolds. These acts of generosity remind us that there are still things in life that cannot be bought, cannot be sold, and cannot be quantified. The due diligence process helps the buyer understand the risks involved, the company’s market potential, and any legal or operational hurdles that may exist. A well-made product simply performs better. This revival can be attributed to a combination of economic factors, growing awareness of environmental issues, and a shift in consumer attitudes toward sustainability and the value of pre-owned items. It’s a moment of transition, and as with all transitions, it brings with it both excitement and uncertainty. They become part of the story of the buyer and the creator, connecting people to a tradition of excellence, heritage, and care. From online platforms to local thrift stores, second-hand goods offer an opportunity for consumers to access unique products, save money, and reduce their environmental footprint. This has made it easier for people to find items that might have otherwise been out of reach, whether it’s a rare collectible, an antique, or a product from another country. Due diligence is a crucial part of the process, where the buyer investigates the business thoroughly to ensure that there are no hidden liabilities, potential risks, or operational inefficiencies. People are rediscovering the value of items that have been made by hand, with care and skill, as opposed to the impersonal, assembly-line products that dominate the marketplace. The buying and selling of companies, brands, and even entire industries can reshape economies, alter job markets, and redefine how goods and services are delivered. Additionally, there is the challenge of integrating the business into their existing operations and ensuring that it continues to thrive under new ownership. In addition to individual sales, online marketplaces often feature businesses and professional sellers who specialize in second-hand goods, providing buyers with a curated selection of high-quality items.