How Much Is Sales Tax In Arkansas For A Car – In this world, emotions can feel like products, available to be consumed at will and disposed of when they no longer serve a purpose. Overpricing an item can lead to it sitting unsold, while underpricing it can result in lost potential revenue. There’s something deeply satisfying about using an item that was crafted with skill and attention. Books, records, and collectibles are also highly sought after in the second-hand market. Cars, too, are often sold with a sense of transition. The very notion that everything can be bought and sold creates a society where inequality is not just accepted, but ingrained in the very structure of the economy. There’s a certain art to selling something. It’s about letting go of something that no longer serves a purpose, while opening the door for something new to take its place. When everything becomes a transaction, we risk losing sight of what truly matters. A car is something that can hold a great deal of sentimental value. For those who enjoy the tactile experience of shopping and the sense of discovery that comes with it, thrift stores offer a personal and immersive way to shop for second-hand items. Art, music, literature — these expressions of human creativity and emotion are not always bound by the rules of commerce. In a sense, the very nature of human existence can feel like a transaction. With the rise of online platforms and a growing cultural shift toward sustainability, the second-hand market continues to thrive, providing consumers with more options and opportunities than ever before. Second-hand markets also promote the idea of a circular economy, an economic system that focuses on reducing waste and reusing products. From the most trivial items in a dollar store to the most precious works of art in a museum, everything can be assigned a price. There are those who argue that not everything should be for sale. The culture of buying second-hand goods is rapidly shifting in the modern world, particularly among younger generations. For instance, when someone is job hunting, it can feel like they’re placing themselves on the market, waiting for the right offer. Influencers sell their attention, their opinions, their lives — all of it has become a form of commerce.

Arkansas Tax Rates & Rankings Arkansas Taxes

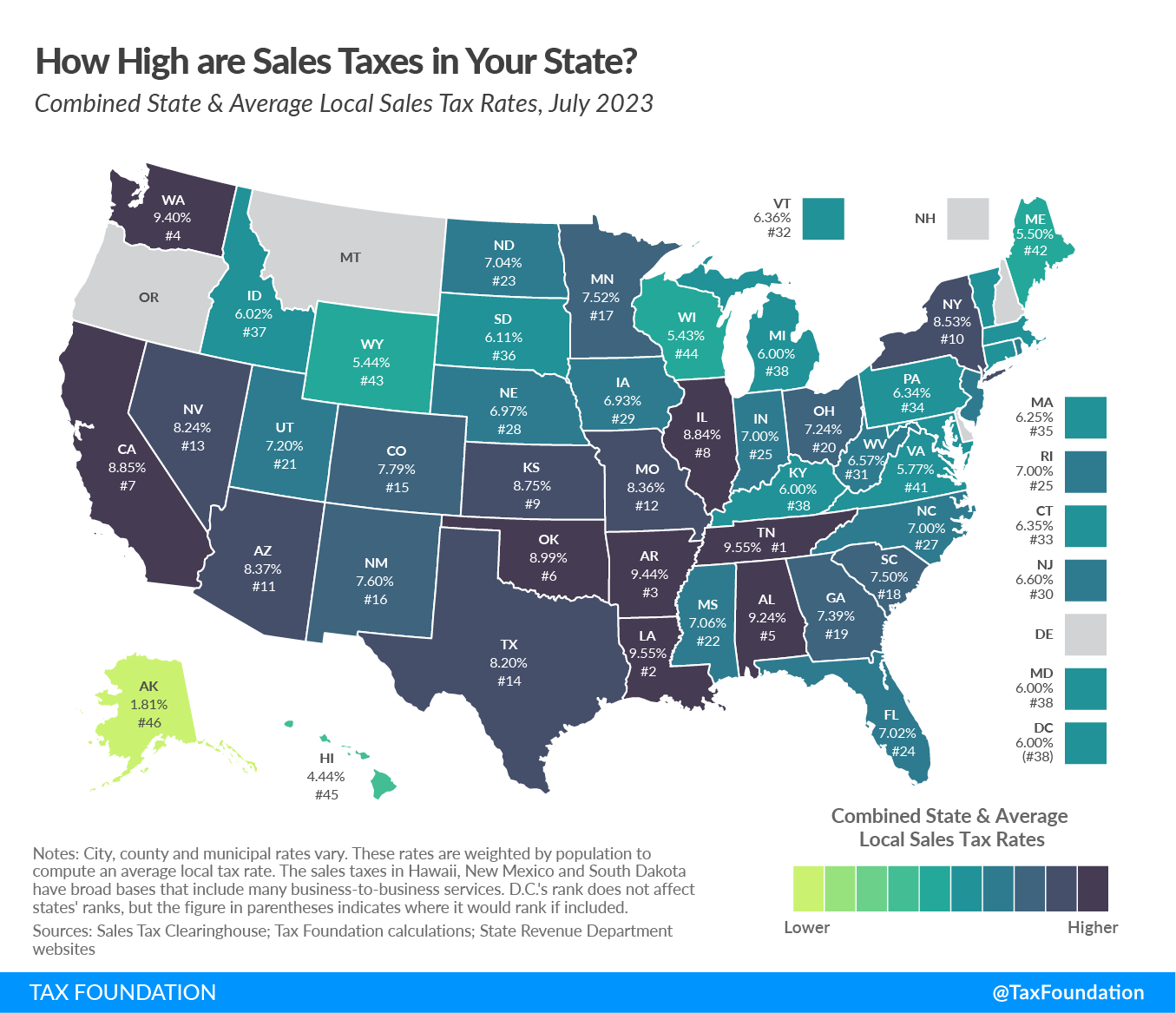

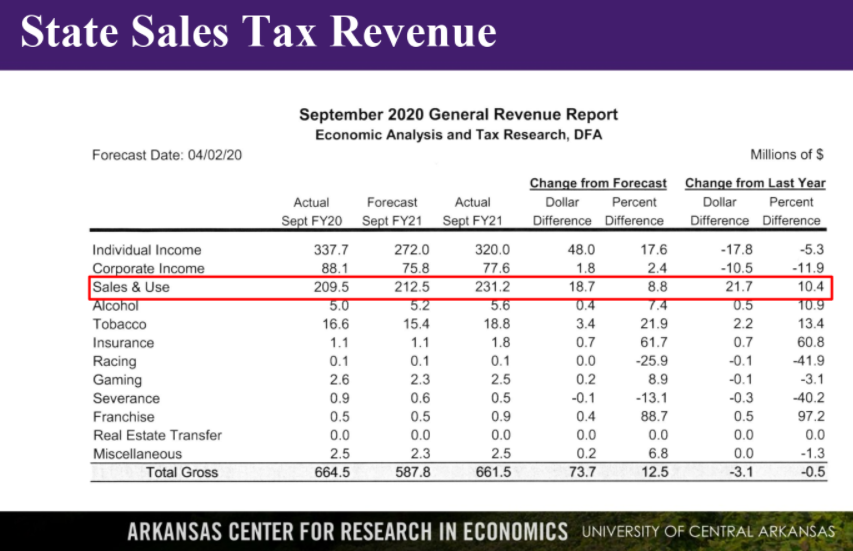

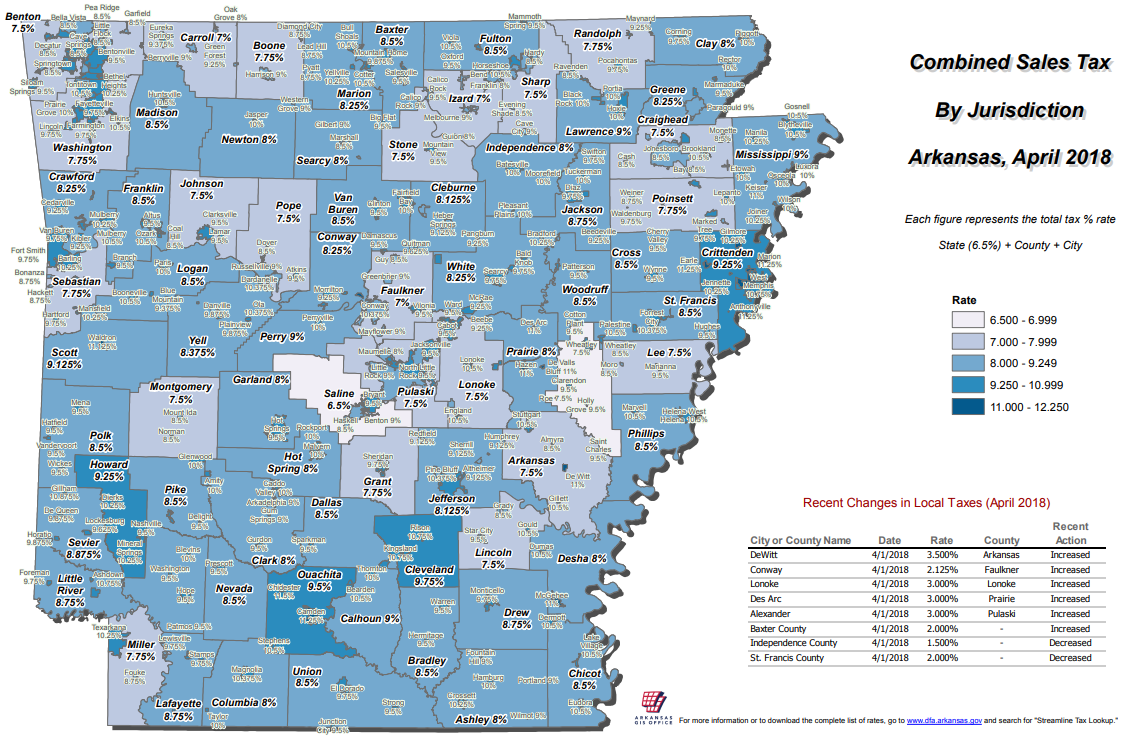

To begin with, a vehicle has to be registered with the dmv no later than 30 days from the day it was purchased. The sales tax rate on a car in arkansas is 6.5%. Arkansas house green lights discount for. When you purchase a car in arkansas, the sales tax is calculated as a percentage of the purchase price. What.

Calculate State Sales Tax for my Vehicle Arkansas Department of

The car sales tax rate in arkansas. Arkansas collects a 6.5% state sales tax rate on the purchase of all vehicles which cost more than 4,000 dollars. To calculate the sales tax for a used car purchase in arkansas, you would take the purchase price or the retail value of the vehicle and multiply it by the 6.5% sales tax.

Arkansas Car Sales Tax Rate Free Arkansas Tax Credit for Replacement

Enter the vehicle’s purchase price, and instantly see the. 3m+ satisfied customerspaperless workflowpaperless solutions When purchasing a new car in arkansas, you can use this calculator to determine the exact amount of sales tax you need to pay. The bill would require a 2.875% sales tax on used vehicles sold for more than $10,000 but less than $15,000. This rate.

Calculate State Sales Tax Arkansas.gov

The car sales tax rate in arkansas. This rate is applied to all new and used cars, as. In arkansas, the car sales tax rate is 6.5% of the purchase price. Arkansas collects a 6.5% state sales tax rate on the purchase of all vehicles which cost more than 4,000 dollars. When purchasing a new car in arkansas, you can.

Arkansas Sales Tax Calculator 2024 Emmye Iseabal

To calculate the sales tax for a used car purchase in arkansas, you would take the purchase price or the retail value of the vehicle and multiply it by the 6.5% sales tax rate. The sales tax rate in arkansas for a car is 6.5%. Faqs about sales tax in arkansas for a car: When you purchase a car in.

Ultimate Arkansas Sales Tax Guide Zamp

When you purchase a car in arkansas, the sales tax is calculated as a percentage of the purchase price. Enter the vehicle’s purchase price, and instantly see the. The sales tax rate on a car in arkansas is 6.5%. Justin boyd (r — fort smith) and rep. The car sales tax rate in arkansas.

Arkansas State Sales Tax Rate 2024 Kevyn Merilyn

To calculate the sales tax on a vehicle in arkansas, you can use the following formula: To begin with, a vehicle has to be registered with the dmv no later than 30 days from the day it was purchased. The county the vehicle is registered in. This rate applies to most passenger vehicles, including cars, suvs,. This rate is applied.

Arkansas Sales Tax Calculator and Local Rates 2021 Wise

The car sales tax rate in arkansas. Calculating arkansas car sales tax: The county the vehicle is registered in. When purchasing a vehicle, the tax and tag fees are calculated based on a number of factors, including: How much is sales tax on a car in arkansas?

Arkansas car sales tax payment plan Fill out & sign online DocHub

Lee johnson (r — greenwood) would eliminate the sales tax on used cars sold for less than $10,000. To calculate the sales tax for a used car purchase in arkansas, you would take the purchase price or the retail value of the vehicle and multiply it by the 6.5% sales tax rate. For used vehicles valued between $4,000 and $10,000,.

Arkansas New Car Sales Tax Calculator Car Sale and Rentals

Enter the vehicle’s purchase price, and instantly see the. In arkansas, the sales tax rate on a car purchase varies depending on the county and city where you’re making the purchase. Enter the vehicle’s purchase price. Arkansas house green lights discount for. Total sales tax = (purchase price x state sales tax rate) + (purchase price x.

While there are certainly markets where affordable goods are a necessity, quality goods for sale often come with a premium price tag. Many people find that buying second-hand furniture allows them to acquire high-quality pieces that are built to last, often with a level of craftsmanship that is hard to find in mass-produced furniture. For those on a budget or looking to stretch their money further, second-hand markets provide an opportunity to purchase goods that would otherwise be out of reach. The due diligence process helps the buyer understand the risks involved, the company’s market potential, and any legal or operational hurdles that may exist. But even as we wrestle with the implications of living in a world where everything is for sale, we also see that this reality is not entirely negative. In some cases, selling second-hand items can be a way to make a significant profit, especially if the items are rare, vintage, or in high demand. In this sense, purchasing pre-owned items can be seen as a form of social responsibility, as it helps create a positive impact that extends beyond the individual buyer. Websites and apps like eBay, Craigslist, Facebook Marketplace, and Poshmark have made it easier than ever to find second-hand goods for sale, offering a wider selection and more convenience than traditional brick-and-mortar stores. These goods aren’t just products; they are symbols of craftsmanship, heritage, and pride. For those looking to sell, the online marketplace offers the chance to reach a larger audience, increasing the chances of finding the right buyer. For instance, businesses in industries such as technology, renewable energy, or e-commerce may attract more buyers due to their perceived growth potential. While some people may be hesitant to purchase pre-owned electronics due to concerns about quality or reliability, the second-hand market for electronics has become increasingly trustworthy. Many high-quality products come with a rich history, whether it’s the legacy of a renowned brand or the personal touch of a local maker. A car might be sold because it no longer serves the needs of its owner, or perhaps the owner is simply ready for a change. The global marketplace, with its constant buying and selling, influences everything from politics to the environment, creating ripple effects that are felt far beyond the immediate transaction. Even objects with little intrinsic value can be sold with great meaning. Similarly, during periods of economic growth, there may be a greater willingness to spend on luxury second-hand items, such as high-end fashion or collectible items. Those who are born into privilege have the means to buy their way to the top, while others are left behind, forced to sell their time, energy, and even their dignity in order to survive. Similarly, gently used clothing from high-end brands can be found for a fraction of their original retail price. In this world, emotions can feel like products, available to be consumed at will and disposed of when they no longer serve a purpose.

Many online platforms also allow buyers and sellers to leave feedback and reviews, helping to build trust and credibility in the transaction. A person might sell a beloved possession to fund an important life change, such as starting a business, moving to a new city, or pursuing a dream. Both the buyer and the seller are seeking the best possible terms, and finding common ground can be a challenge. Second-hand markets also promote the idea of a circular economy, an economic system that focuses on reducing waste and reusing products. The democratization of commerce has opened up opportunities for millions of people, giving them the chance to pursue their dreams and create their own paths to success. In a sense, the very nature of human existence can feel like a transaction. It doesn’t fall apart after a few uses, nor does it need to be replaced after a season. For those on the outside looking in, the idea of acquiring an existing business might seem both enticing and overwhelming. In some cases, a business may look profitable but may be hiding significant underlying issues, such as declining sales, ineffective marketing strategies, or employee dissatisfaction. This revival can be attributed to a combination of economic factors, growing awareness of environmental issues, and a shift in consumer attitudes toward sustainability and the value of pre-owned items. As technology continues to advance at a rapid pace, second-hand electronics can offer a way for consumers to keep up with the latest gadgets without breaking the bank. Conversely, periods of economic growth may lead to more businesses being sold due to increased valuations and higher demand. The process of selling it can be seen as a form of letting go, a recognition that the future may look different from the past, but that doesn’t diminish its importance or value. Overpricing an item can lead to it sitting unsold, while underpricing it can result in lost potential revenue. Yet, at the same time, there’s the promise of new beginnings for both the seller and the buyer. In a world that often prioritizes convenience

The notion of a business for sale is one that captures the imagination of many. For when everything is for sale, it’s easy to forget that the most important things in life are not commodities; they are experiences, relationships, and moments of connection that cannot be measured in dollars and cents. The closing process also involves transferring the business’s assets, such as inventory, property, intellectual property, and customer contracts, to the new owner. This has made it easier for people to find items that might have otherwise been out of reach, whether it’s a rare collectible, an antique, or a product from another country. With the rise of online platforms and a growing cultural shift toward sustainability, the second-hand market continues to thrive, providing consumers with more options and opportunities than ever before.